Open or closed? It’s a question many people don’t even think to ask until it’s too late. Nobody can predict what will happen in life-an accident, an illness, or a disease of age can unexpectedly take away someone’s ability to be in control of their own finances.

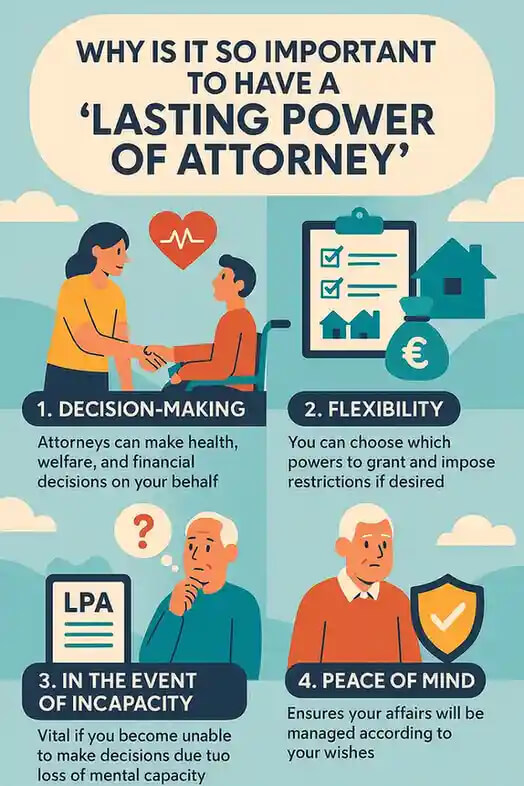

At times like this, the LPA for property and financial affairs is what stands between peace of mind and months (or years) of legal nightmares for those you love.

What is a Lasting Power Of Attorney (LPA) for Property & Financial Affairs?

Lasting Power of Attorney for Property and Financial Affairs (LPA) LPA for property and financial affairs is a legal document that lets you appoint someone, known as an attorney, to make decisions about your money and property on your behalf. " this means managing your bank accounts, paying bills, selling or hanging onto you property and all other areas of your financial life.

For more details, visit https://maidenhead.wills4less.co.uk/lasting-power-of-attorney-property-finances/

The LPA for Property & Financial Affairs provides your appointed attorney with the legal power to act on your behalf, only in the event that you are unable to do so due to ill health, injury or impairment. It’s a key document that can help safeguard your assets and ensure that your financial matters are administered as you wish when you pass away.